IntraFi® Network Deposits℠

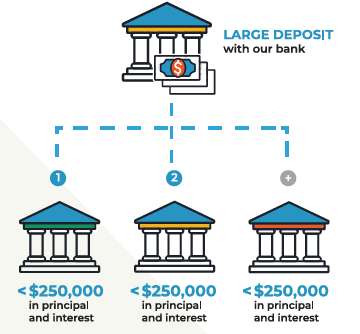

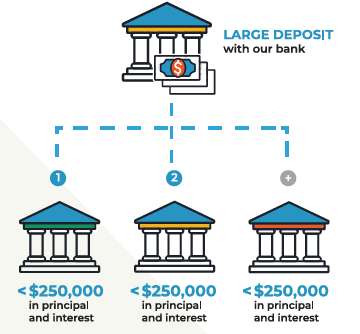

IntraFi Network Deposits (formerly known as ICS® and CDARS®) is a smart, secure, and convenient way to safeguard large deposits placed into demand deposit accounts, money market deposit accounts, or CDs.

With IntraFi Network Deposits, you can access multi-million-dollar FDIC insurance and earn interest, all through a single AVB Bank relationship.

Why IntraFi Network Deposits?

- Peace of Mind - Make funds eligible for protection that extends well beyond $250,000 and that is backed by the full faith and credit of the federal government. No one has ever lost a penny of FDIC-insured deposits.

- Liquidity - Maintain access to your funds placed in demand deposit accounts and money market deposit accounts. With CD placements, select from multiple term options to meet your liquidity needs.

- Interest - Put excess cash balances to work by placing funds into demand deposit accounts (using the demand option), money market deposit accounts (using the savings option), or CDs (using the CD option) at rates set by AVB.

- Time Savings - Work directly with AVB - a bank you know and trust - to access multi-million-dollar FDIC insurance and say goodbye to tracking collateral on an ongoing basis, managing multiple bank relationships, manually consolidating bank statements, and other time-consuming workarounds.

- Community Investment - Feel good knowing that the full amount of funds placed through IntraFi Network Deposits can support local lending opportunities that build a stronger community.¹

Placement of funds through IntraFi Network Deposits is subject to the terms, conditions, and disclosures in the program agreements, including the Deposit Placement Agreement (“DPA”). Limits apply, and customer eligibility criteria may apply. Program withdrawals may be limited to six per month for funds placed in MMDAs. Although funds are placed at destination banks in amounts that do not exceed the FDIC standard maximum deposit insurance amount (“SMDIA”), a depositor’s balances at the relationship institution that places the funds may exceed the SMDIA (e.g., before settlement for a deposit or after settlement for a withdrawal) or be ineligible for FDIC insurance (if the relationship institution is not a bank). As stated in the DPA, the depositor is responsible for making any necessary arrangements to protect such balances consistent with applicable law. If the depositor is subject to restrictions on placement of its funds, the depositor is responsible for determining whether its use of IntraFi Network Deposits satisfes those restrictions. Network Deposits and the IntraFi hexagon are service marks, and IntraFi, the IntraFi logo, ICS, and CDARS are registered service marks of IntraFi Network LLC.

[1] When deposited funds are exchanged on a dollar-for-dollar basis with other banks that offer IntraFi Network Deposits, our bank can use the full amount of a deposit placed through IntraFi Network Deposits for local lending, satisfying some depositors’ local investment goals or mandates. Alternatively, with a depositor’s consent, our bank may choose to receive fee income instead of deposits from other banks. Under these circumstances, deposited funds would not be available for local lending.

[2] Funds are placed into demand deposit accounts, money market deposit accounts, or both, when using ICS and into CDs using CDARS.