To Our Valued Customers:

AVB Bank recognizes the importance of adapting to the dynamic and ever-changing digital enhancements within the financial services industry. Over the last year, we have been preparing for a major technological overhaul to upgrade our digital footprint and enhance the way you do banking. We are thrilled about these improvements, which will significantly enhance the services we provide and reinforce our dedication to serving you.

We understand changes can be difficult, and we're here to help:

- Questions? Concerns? Need help registering?

- Call - 918.251.9611

- Chat with us online - simply click the chat bubble in the bottom right corner of your screen

- Our Digital Ambassadors and Customer Accounting representatives are available Monday - Friday | 8:30am to 4:30pm

It's important to know that these items have not changed:

- Credit cards, debit cards, and checks will all function normally

- Bank account numbers

- Automatic ACH credits and debits, going into or leaving your account, will continue to post as normal

- AVB Bank's routing number: 103102892

- AVB Telephone Banking number: 918.251.2872

What's New for Commercial Customers:

Our new digital banking platform was built with businesses of all sizes in mind to meet your unique needs and help grow your business. We recognize that businesses are consumers too and we know you expect an intuitive business banking experience. The new business banking platform delivers a seamless user experience across your mobile, tablet, and desktop - enabling you to easily navigate digital banking and manage your finances wherever your business takes you.

With the new business banking platform, you'll gain access to:

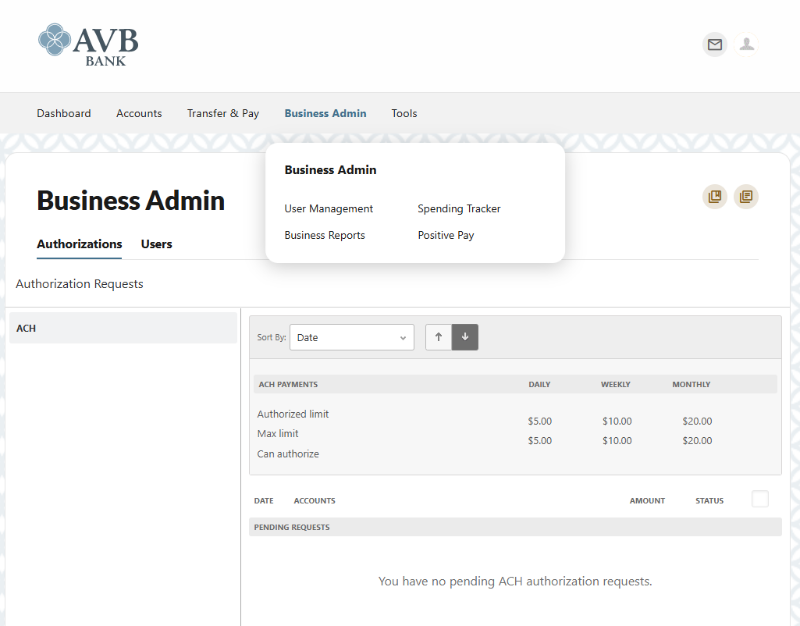

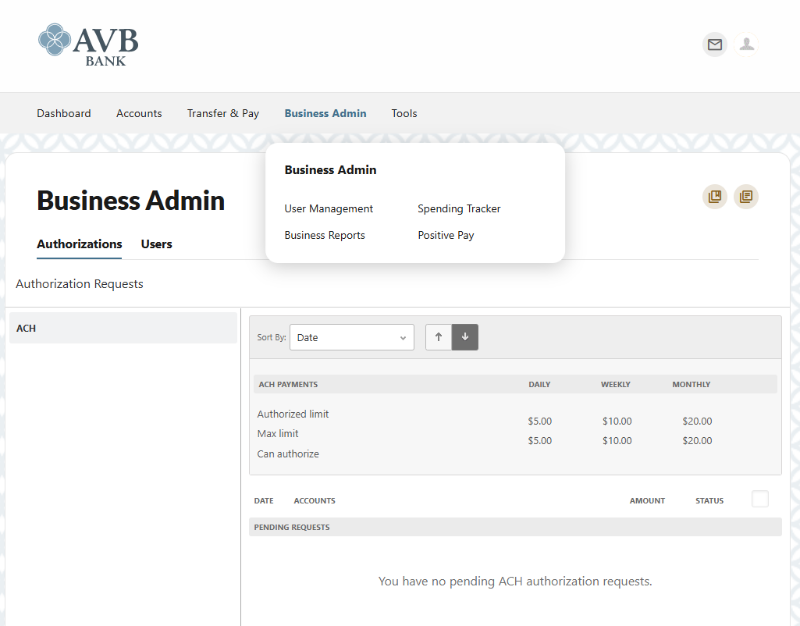

- Business Admin: Provides you with the tools to set up, maintain, and manage the various aspects of your digital banking experience. the User Management menu serves as the hub for Authorizations, Payees, and Users.

- Business Reports: Provides you with the ability to access Standard Reports and create Custom Reports. Custom Report generation tools provide you with the ability to generate new reports to yield new insights on your ACH details and transaction history.

- Account Aggregation/Link External Accounts: Add accounts from other financial institutions to get a complete picture of your finances.

- User Transfers: Transfer funds quickly and easily to another AVB User and even set recurring transfers or payments.

- Savings Goals: Set up, edit, and updated savings goals and track their progress as they go.

- Account Analytics: Provides a clear understanding of your spending habits, offering insights that help you manage your money more effectively.

- Coming Soon:

- Card Rewards

- Debit Card Management

- ACH Positive Pay

Digital Banking FAQs:

- What does AVB Bank need from me?

- It is important that AVB Bank have your most current information. Take time in the next couple of weeks to look over the phone number and email address that is currently listed online. If it has changed, please let your local branch know right away so we can update your information.

- Will I have to redownload my Mobile Banking App?

- Yes, simply download it from your device's app store by searching for "AVB Bank" and enjoy the convenience of our free online banking services.

- How do I log-in if the phone number or email address is incorrect or missing?

- If the phone number or email that appears is incorrect or missing, contact any of our branches so we can update the information.

- Can I use my existing username and password?

- You will be initially granted access using the existing username and password; however, in order to retain the same password, it must meet the new password requirements.

- 10 - 25 characters

- Contains each of the following - an uppercase letter, lowercase letter, a numerical digit, and a special character

- What if I forgot my username or password?

- Using the "Forgot Username" process and after verifying your identity with a one-time code, you'll be able to recover your username.

- Using the "Forgot Password" process and after identifying your identity with a one-time code, you'll be able to create a new password seamlessly.

- Will I need to re-enroll in eStatements?

- Yes, upon your first login, you'll be prompted to enroll in eStatements. Alternatively, you can always enroll later using our eStatements widget.

- Will my account activity/history/eStatements transfer over?

- Yes, your account activity, history, and eStatements will seamlessly transfer without any action required on your part.

- Will my account names and settings transfer over?

- Unique account nicknames and account settings will not transfer. to update your account settings, simply view the settings widget.

- Will my BillPay information carry over to the new digital banking platform?

- BillPay service will not be affected. All payees, scheduled payments, and payment history will seamlessly transfer without any action required on your part.