To Our Valued Customers:

AVB Bank recognizes the importance of adapting to the dynamic and ever-changing digital enhancements within the financial services industry. Over the last year, we have been preparing for a major technological overhaul to upgrade our digital footprint and enhance the way you do banking. We are thrilled about these improvements, significantly enhancing the services we provide and reinforce our dedication to serving you.

We understand changes can be difficult, and we're here to help:

- Questions? Concerns? Need help registering?

- Call - 918.251.9611

- Chat with us online - simply click the chat bubble in the bottom right corner of your screen

- Our Digital Ambassadors and Customer Accounting representatives are available Monday - Friday | 8:30am to 4:30pm

It's important to know that these items have not changed:

- Credit cards, debit cards, and checks will all function normally

- Bank account numbers

- Automatic ACH credits and debits, going into or leaving your account, will continue to post as normal

- AVB Bank's routing number: 103102892

- AVB Telephone Banking number: 918.251.2872

Other Important Information:

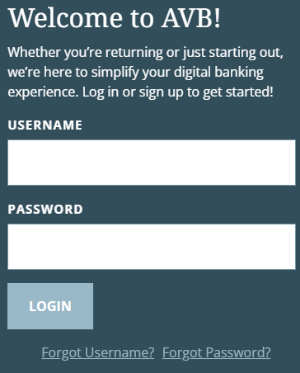

- Online & Mobile Banking - We have converted to a new Online & Mobile Banking provider.